The Griffin-Spalding County School System (GSCS) announces its intention to roll back the 2025 property taxes it will levy this year by .347 mills to equal the rollback millage rate.

A millage rate is the means by which a school system or other organization generates revenue to fund its budget (levy taxes, in mills, for purposes of financing the expenses for the fiscal year).

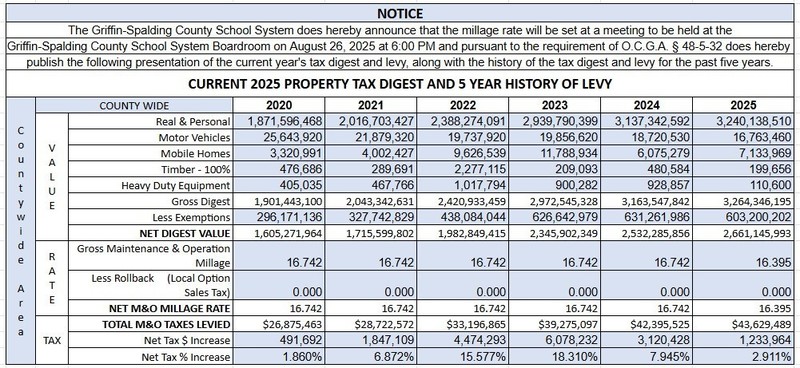

The GSCS millage rate was 16.742 mills from 2020 to 2024. In 2019, 2018, 2017 and 2016, the GSCS millage rate was 17.078, 18.066, 18.204, 18.570 and 18.742. From 2012 through 2014, the GSCS millage rate was 19.470. It remained the same for three consecutive years (2012 -2014) before being rolled back six straight years until it reached the previous rate 16.742. The proposed 2025 rate of 16.395 will mark the lowest school system millage rate in more than 20 years.

Each year, the board of tax assessors is required to review the assessed value for property tax purposes of taxable property in the county. When the trend of prices on properties that have recently sold in the county indicate there has been an increase in the fair market value of any specific property, the board of tax assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment.

When the total digest of taxable property is prepared, Georgia law requires a rollback millage rate must be computed that will produce the same total revenue on the current year’s digest that last year’s millage rate would have produced had no reassessments occurred.

The budget tentatively adopted by GSCS requires a millage rate equal to the rollback millage rate; therefore, before GSCS may finalize the tentative budget and set a final millage rate, Georgia law requires that the board of education hold a public meeting to adopt a final millage rate.

There will be a called board meeting for the adoption of this tax rollback in the GSCS Boardroom located at 216 South 6th Street in Griffin, GA on August 26, 2025, at 6 p.m.

Other school systems in close proximity of Spalding County had the following millage rates for 2024:

Spalding: 16.395 (proposed 2025 rate)

Clayton: 19.600

Fayette: 19.60

Pike: 14.000 plus a bond rate of 0.755

Troup: 17.350

Rockdale: 20.000

Upson: 13.63

Muscogee: 23.075

Newton: 15.75

Lamar: 14.000 plus a 1.50 bond rate

The Millage Rate for 2024 was 16.742. The proposed Millage Rate for 2025 is 16.395. There is a proposed rollback to the millage rate. The proposed Millage Rate for 2025 will be rolled back by 0.347 mills.